SMS for the financial services sector

We help the financial sector to protect their customers, fight fraudsters and automate updates.

Unleash the power of SMS within the financial sector

With 4 out of 10 people in the UK regularly using mobile banking apps to access their accounts, it’s unsurprising that SMS is becoming an essential part of the financial services sector. By 2023, it is predicted that 72% of the UK adult population will use their smartphones to access their bank account.

- Mobile banking increase

- Advance SMS security

- 76% of people are using internet banking UK-wide in 2021

In 2021, 14 million Britons have an account with one of the digital banks

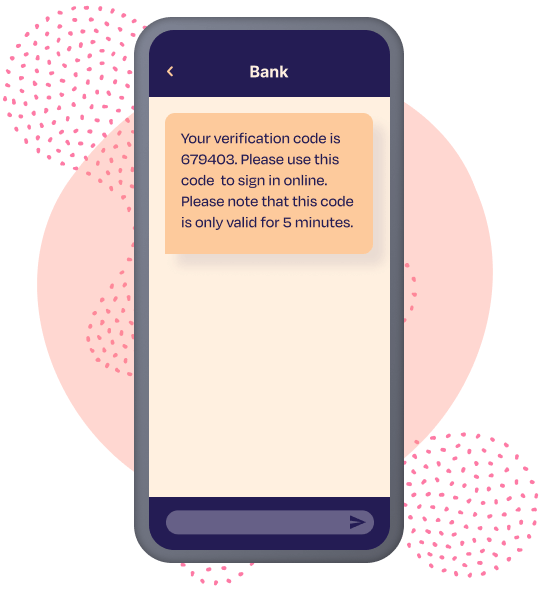

Fraud protection

Use SMS to create a two-factor authentication process to protect customers from fraud.

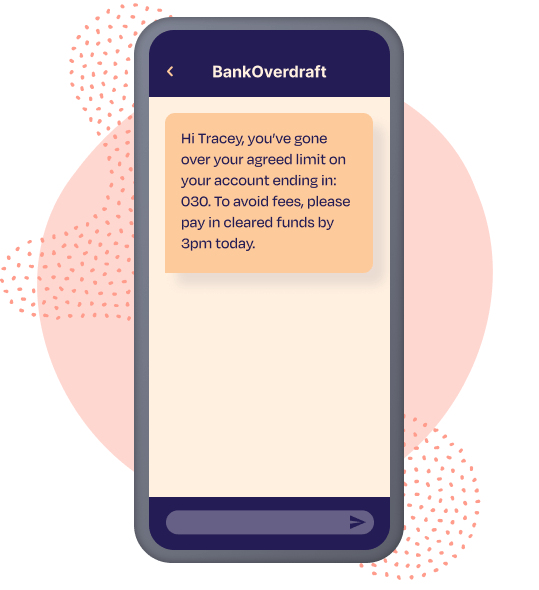

Overdrawn warning

Customers can receive a text message when their bank balance has gone overdrawn.

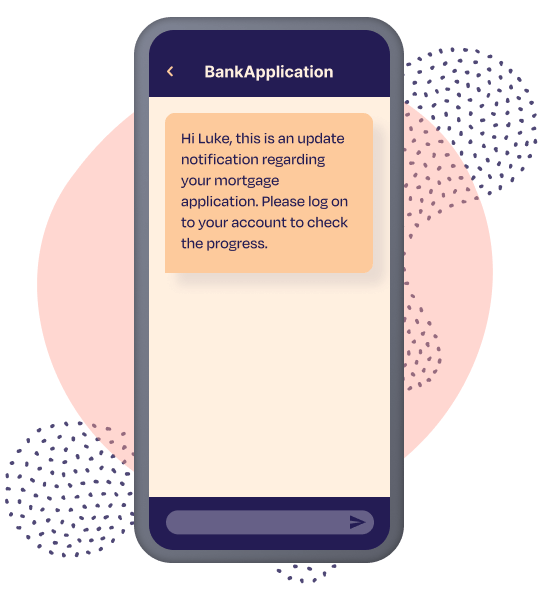

Application update

Automated SMS messages can be sent to your customers regarding application statuses.

Fraud protection

Unauthorised UK financial fraud losses across payment cards, remote banking and cheques totalled £783.8 million in 2020.SMS can be used to create a two-factor authentication process to protect banks and customers from fraudulent attempts. If a customer is logging on to an online banking platform from a new device, our SMS service can send a verification code to the customer’s phone number, creating an additional security authentication. This SMS may contain a code, which must be entered into the online platform to verify that the attempted login is from the customer and not fraudulent activity.

- Two-factor authentication

- Verification codes

- Fraud protection

Overdrawn warning

Debit card payments are set to overtake cash as the most popular way to purchase items. With debit card payments on the rise and spending with cash declining, it’s becoming integral that customers are informed when they are overspending. Through our SMS service, customers can receive a text message when their bank balance has gone overdrawn. To avoid any overdraft fees the message could include instructions on how and when to clear the funds. Other notifications such as when a large transaction has taken place or cash has been transferred into the account can also be sent through SMS.

- Overdraft notification

- Balance updates

- Large transaction texts

Application update

Financial applications tend to take a while to be processed, on average, mortgage applications take 18-40 days to be approved. Due to complex processes with several stages, it’s important to keep customers updated with information as to their application status. With SMS boasting an impressive 97% open rate, customers will quickly and easily be updated when their application passes through to the next stage of checks. If the information is sensitive, a text message can be sent to the customer asking them to sign-in online to review their application.

- Update SMS notifications

- Request SMS

- Automated SMS

Our partnership with TextAnywhere has grown over the past four years, and their service remains completely reliable and great value.

Paul Turner – IT Manager at Advantage Finance

Start your free trial today

Try our platform; you’re only a few clicks away

- 20 free credits

- Full platform access

- No commitment or credit card required